Don't Rely On Your Homeowners Policy For Business Insurance

At NextGen, we help many small businesses. Helping small businesses often means helping home based businesses. When you have little or no employees, why spend a fortune on office space when your job probably allows you to work from home? Working from home is great; we encourage it! However, we are often met with objections on covering business contents because these home based business owners and consultants think their homeowners policy covers them for their business contents.

7 Simple Steps to Buying the Right Business Insurance

No one really likes the process of researching and buying business insurance. However utilizing some simple steps can make the process go faster and smoother! Here are seven simple steps to buying the right business insurance.

Disaster Planning for Your Business

Recent catastrophes, natural disasters, and pandemics serve as good reminders that businesses need disaster plans just as much as homes and families. In the midst of an earthquake, flood, fire or severe storm that causes irreparable damage, it's hard to think beyond "we've lost everything." But if you've carefully planned out what to do in a disaster, it doesn't have to mean a total loss...

Do I Need Insurance for My Home Based Business?

More people are working from home than ever before. The COVID-19 pandemic has changes the most businesses operate. If you run a small business out of your home you might be wondering if you need a business insurance policy.

You might be surprised to know that half of businesses in America are home-based. Whether you are a professional consultant, a dog walker, an Amazon Reseller or a cosmetic sales associate odds are good that you do not carry business insurance or believe you have coverage on your homeowners policy for your business.

Coronavirus and Loss of Business Income Insurance

The Covid-19 virus, also known as Corona Virus has affected many businesses. If you hold a business package policy or business owner policy you may be wondering if your policy will cover the loss of income you may have been suffering. The short answer is NO. Most policies have a bacteria or virus exclusion for property insurance. In order for business income to be triggered there needs to be a covered cause of loss.

3 Reasons Why Every Business Should Consider Cyber Liability Insurance

It wasn’t that long ago that businesses didn’t have websites, didn’t communicate with customers digitally and didn’t have an exposure to cyber liability. It wasn’t even that long ago when insurance for cyber related crimes was invented… We all probably know someone or some business that has been affected by hacking. Here are three reasons why every business should consider purchasing cyber liability.

Understanding Product Recall Insurance

Commercial general liability insurance offers product liability, but not the costs associated with recalling your product. If you manufacture a product then you likely have a product recall exposure. The cost to recall, destroy and crisis management to "clean up" after a recall could be in the hundreds of thousands or millions depending on the extent of your product in the marketplace.

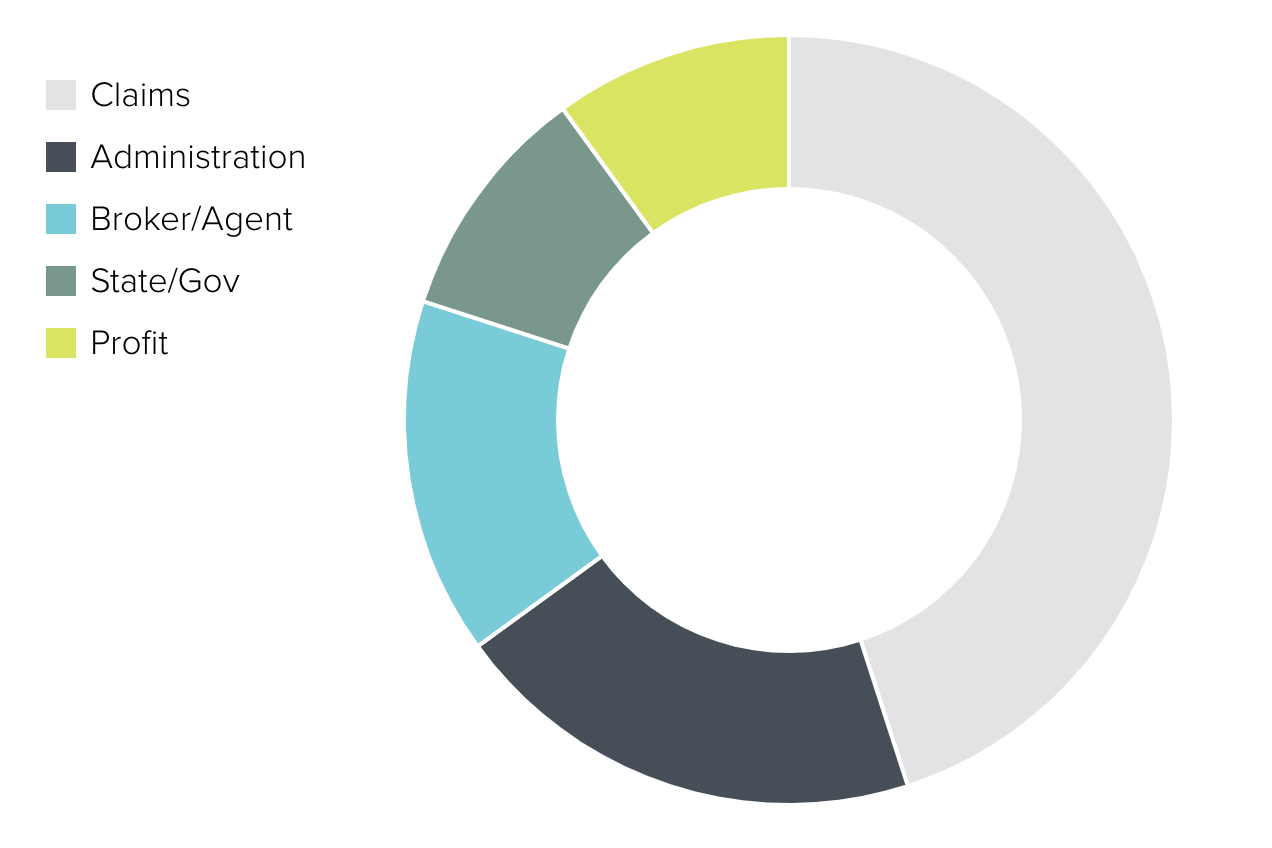

Where Does Your Premium Go?

You probably feel like you pay a lot of money for your business insurance. You might be wondering where your hard earned dollars are going when you pay your insurance every month or year... Our industry could do a better job of explaining what typically happens to the average insurance dollar you pay. This entry will attempt to explain just that.