Insuring a Teen Driver

Organize and Optimize Your Home Office

Home Based Business Insurance: What You Need To Know

5 Simple Steps to Prevent Cyber Breaches While Working Remote

For the past month, most people who can work remotely are working remotely. The Coronavirus has increased remote work which is also increasing cyber threats. Many businesses were not prepared for employees to use their own devices and work in this shelter in place environment so quickly. Here are five simple steps to help protect you when working from home.

Do I Need Insurance for My Home Based Business?

More people are working from home than ever before. The COVID-19 pandemic has changes the most businesses operate. If you run a small business out of your home you might be wondering if you need a business insurance policy.

You might be surprised to know that half of businesses in America are home-based. Whether you are a professional consultant, a dog walker, an Amazon Reseller or a cosmetic sales associate odds are good that you do not carry business insurance or believe you have coverage on your homeowners policy for your business.

Do I Need a Personal Umbrella Policy?

Maybe you just bought your first house, had your first child or had some other life-changing event. Then you start to worry, “Do I have enough insurance?” Adulting is hard and paying for insurance that you may never need can be harder. However, a personal umbrella policy buys peace of mind at a very affordable price.

What Is an Experience Modification?

Workers' compensation insurance can be a large expense for most businesses, especially in higher-risk industries. If you're an established business, chances are that you probably already know about experience modifications. If not, you should familiarize yourself with this important and potentially huge premium saving factor. A quick read below will explain what an Experience Modification (x-mod) is and how it can save or cost you thousands of dollars every year…

Coronavirus and Loss of Business Income Insurance

The Covid-19 virus, also known as Corona Virus has affected many businesses. If you hold a business package policy or business owner policy you may be wondering if your policy will cover the loss of income you may have been suffering. The short answer is NO. Most policies have a bacteria or virus exclusion for property insurance. In order for business income to be triggered there needs to be a covered cause of loss.

What Is a Waiver of Subrogation?

Is My Business Insured for Drone Usage?

Maybe you are inspecting properties, showcasing a property or product, producing your own marketing videos or viewing and recording an event they are hosting or sponsoring. Many businesses are starting to use drones. The use of drones, or unmanned aircraft systems (UAS), has recently grown in popularity, particularly over the past several years. The Federal Aviation Administration (FAA) estimates that approximately 30,000 drones will be used for commercial purposes this year. The commercial use of drones creates insurance liability and coverage implications, ranging from personal injury to privacy invasion and aerial surveillance to data collection. You need to protect your business before deciding if you are going to fly a drone.

What Is Building Ordinance Coverage?

Commercial Auto Insurance Rates Are on the Rise

Insurance is cyclical. Rates tend to fluctuate based on the economy, catastrophic losses, availability of reinsurance, and a number of other reasons. Most business insurance lines of coverage are soft right now, meaning rates are down. However, certain types of coverage are on the rise and getting more difficult to place. Commercial auto is especially affected now due to the cost of repair and liability expenses going through the roof.

3 Reasons Why Every Business Should Consider Cyber Liability Insurance

It wasn’t that long ago that businesses didn’t have websites, didn’t communicate with customers digitally and didn’t have an exposure to cyber liability. It wasn’t even that long ago when insurance for cyber related crimes was invented… We all probably know someone or some business that has been affected by hacking. Here are three reasons why every business should consider purchasing cyber liability.

Understanding Product Recall Insurance

Commercial general liability insurance offers product liability, but not the costs associated with recalling your product. If you manufacture a product then you likely have a product recall exposure. The cost to recall, destroy and crisis management to "clean up" after a recall could be in the hundreds of thousands or millions depending on the extent of your product in the marketplace.

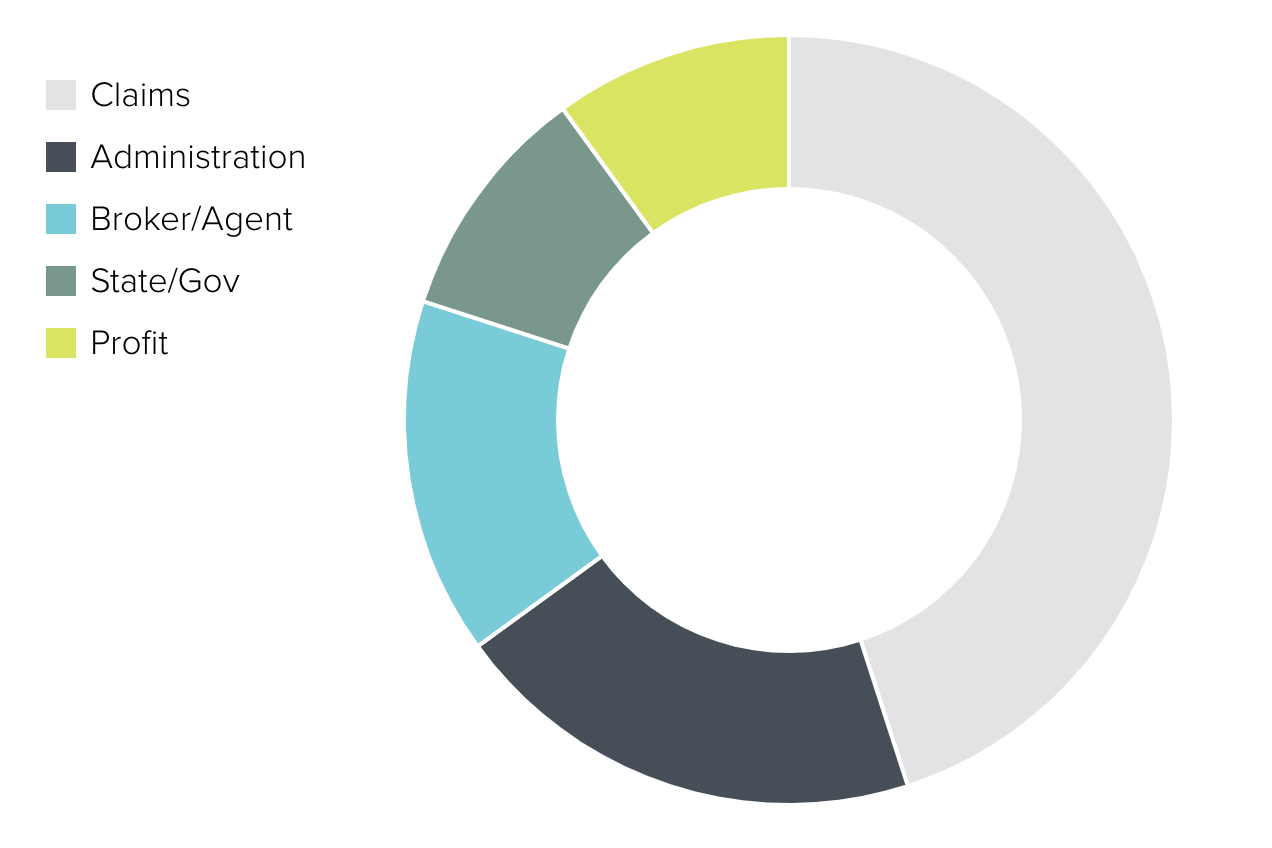

Where Does Your Premium Go?

You probably feel like you pay a lot of money for your business insurance. You might be wondering where your hard earned dollars are going when you pay your insurance every month or year... Our industry could do a better job of explaining what typically happens to the average insurance dollar you pay. This entry will attempt to explain just that.